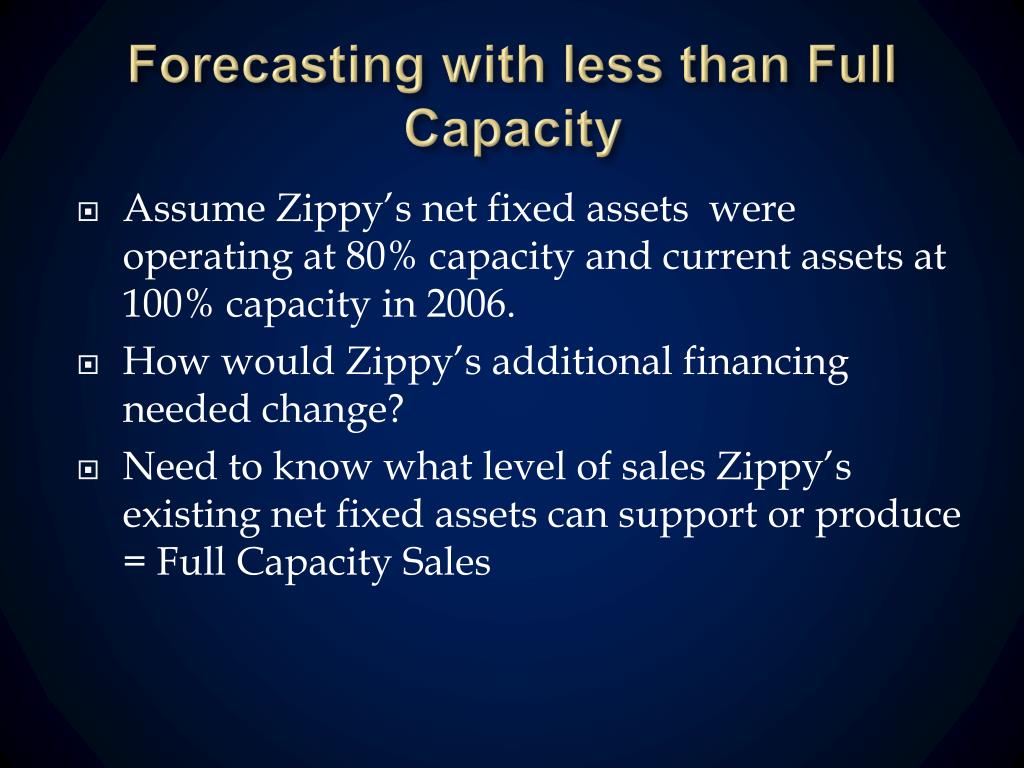

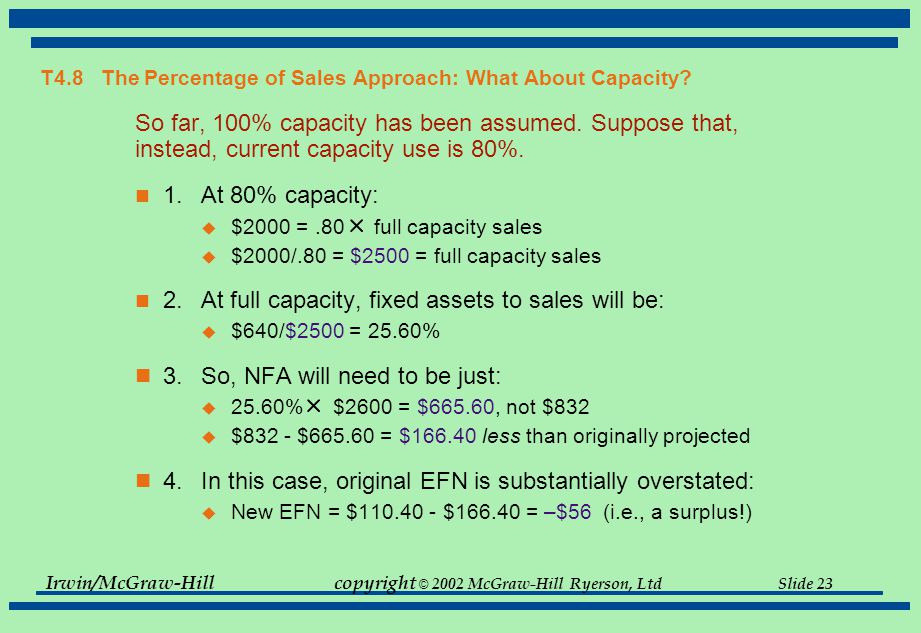

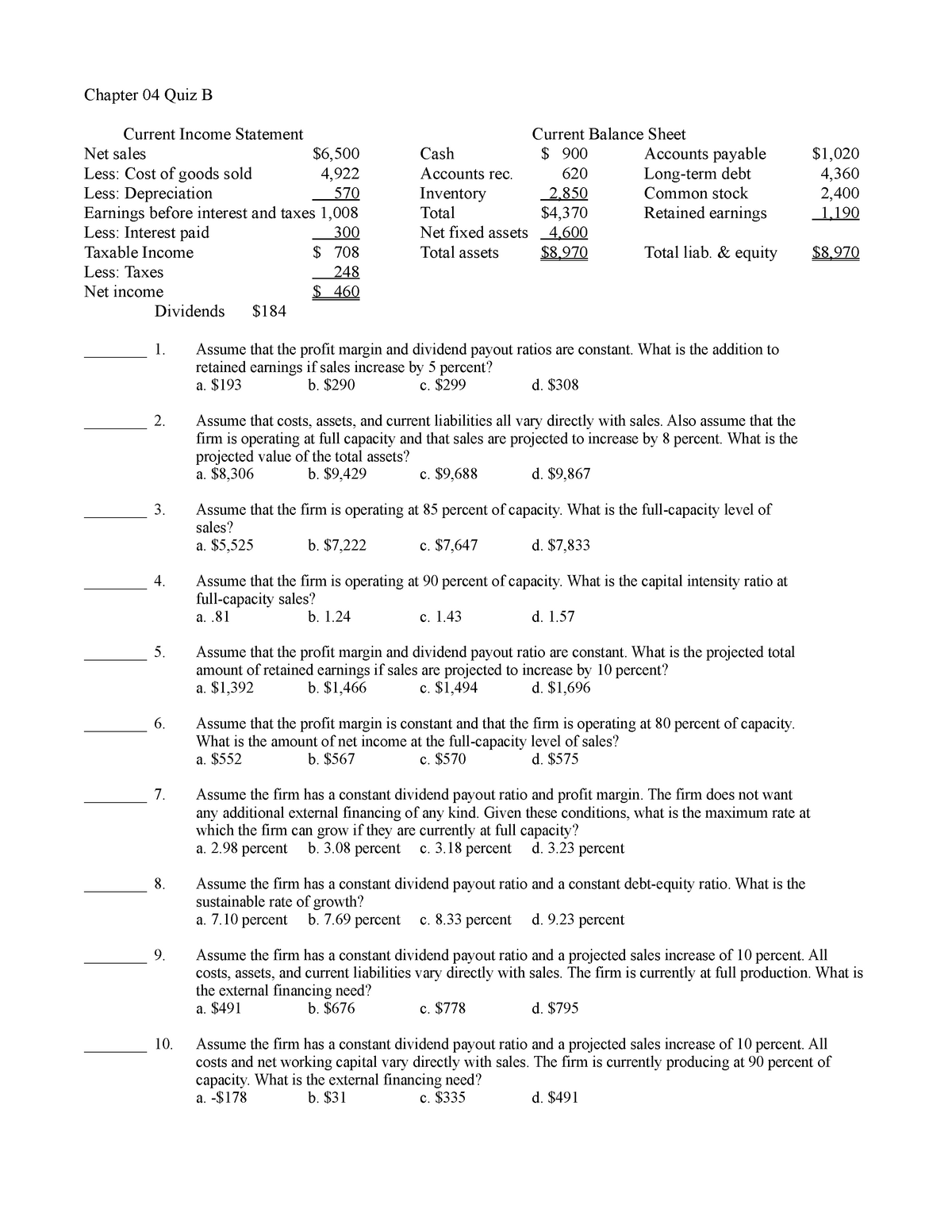

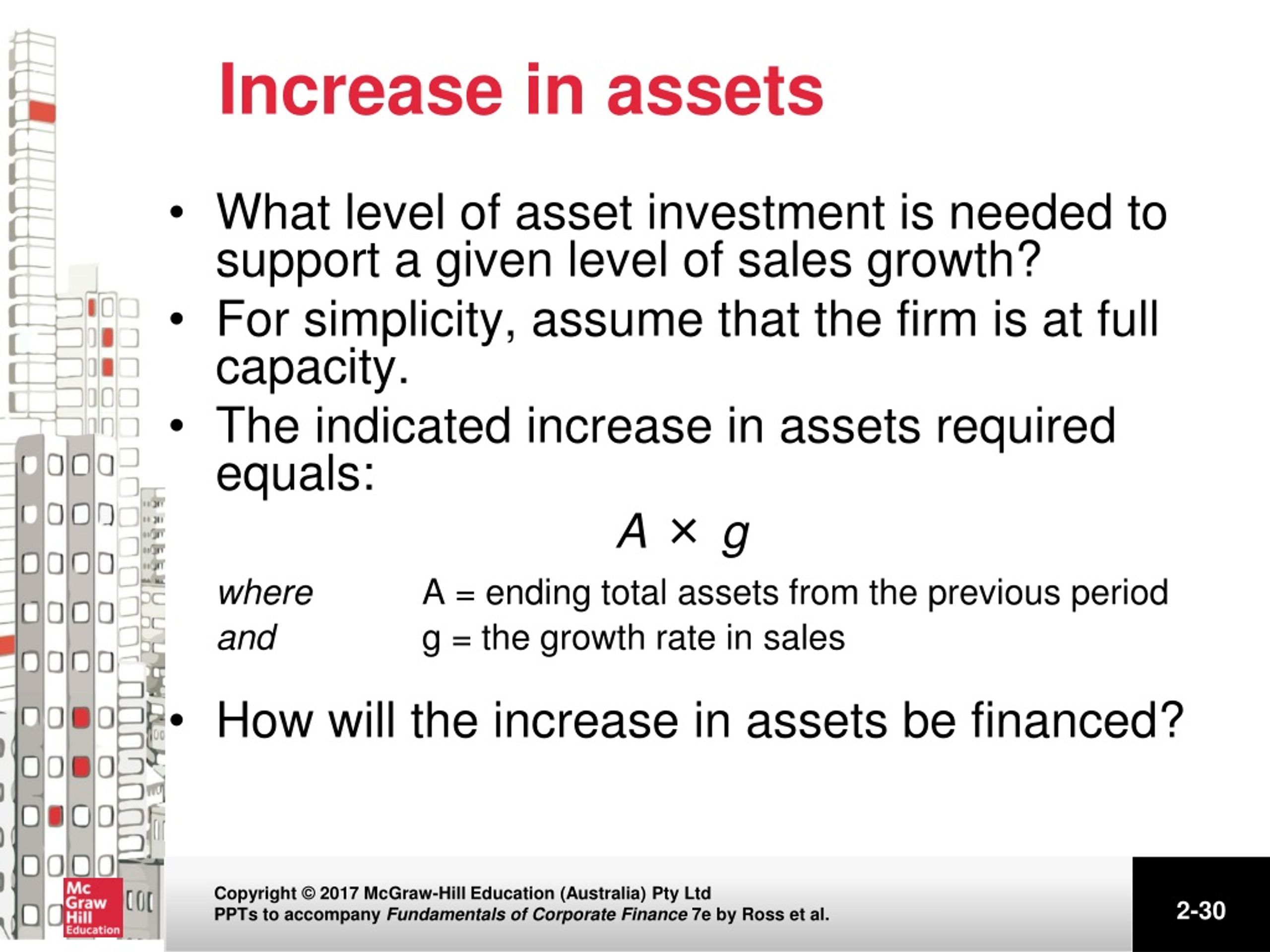

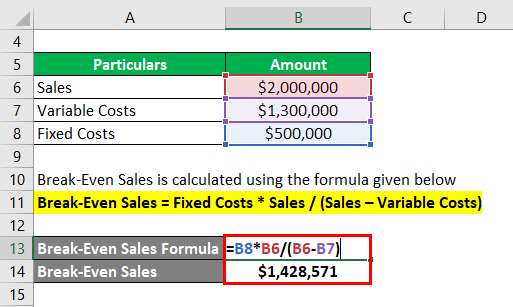

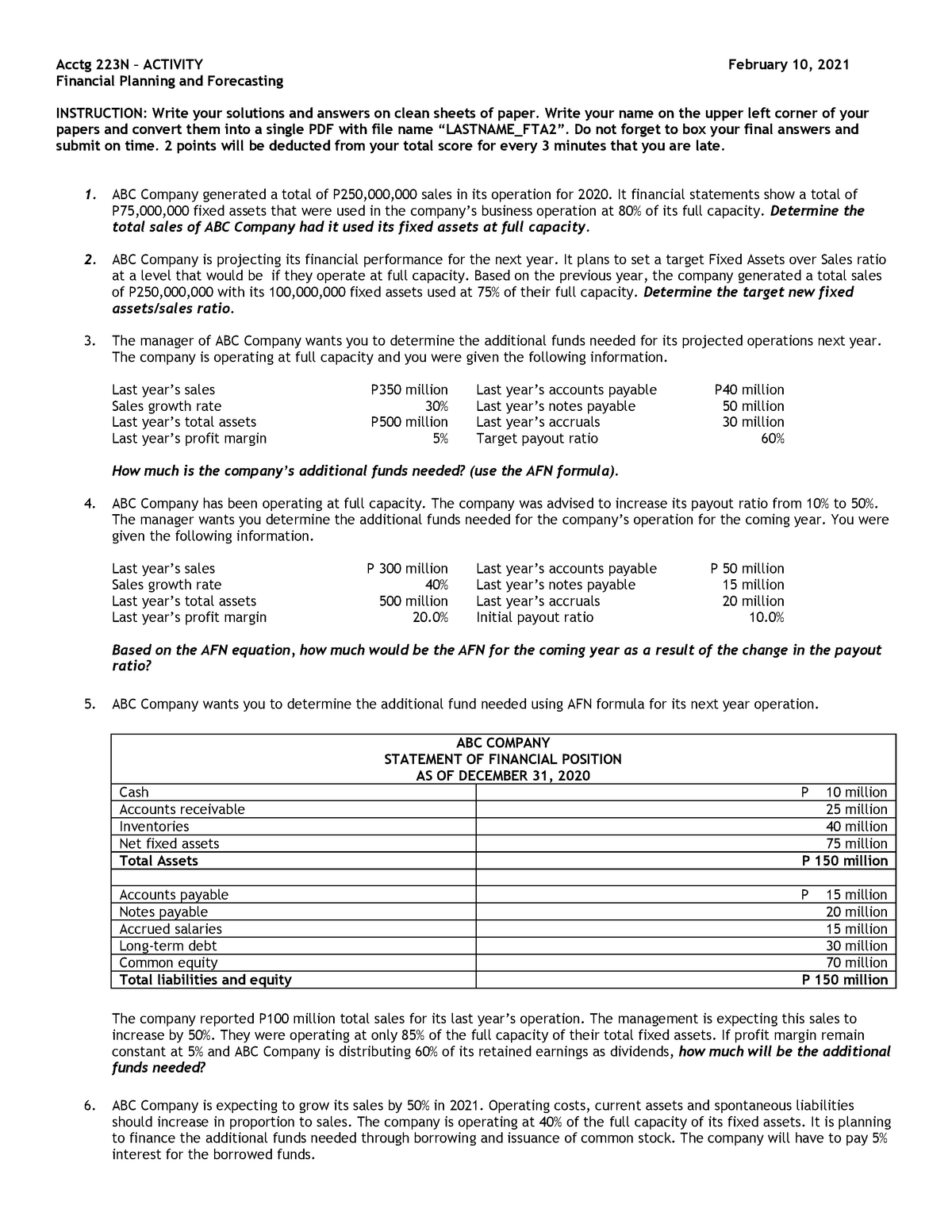

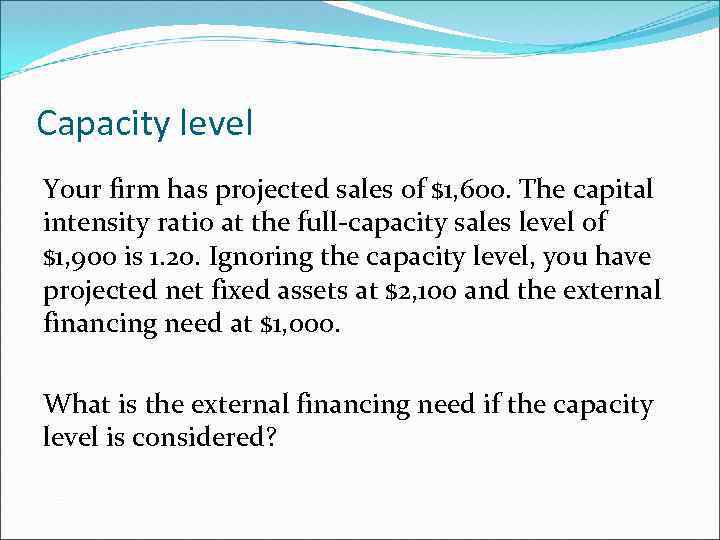

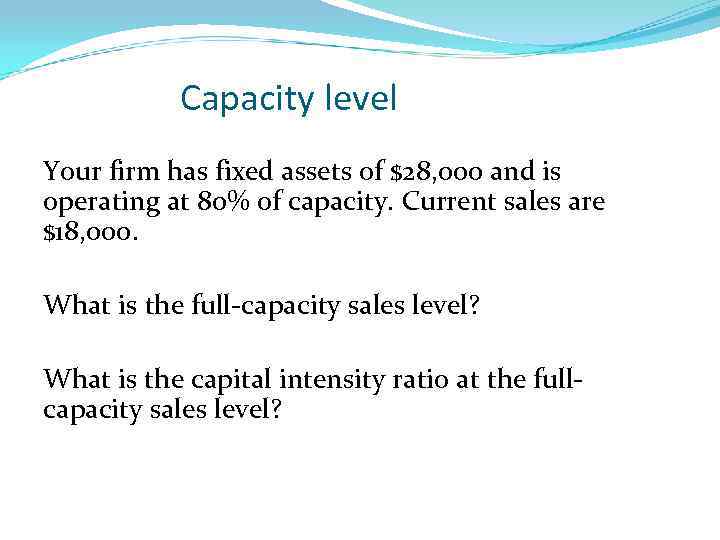

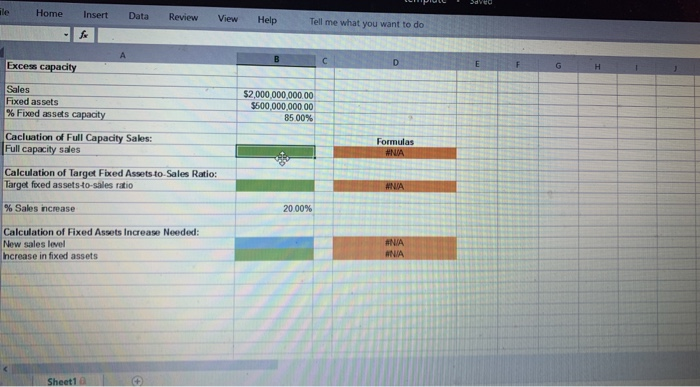

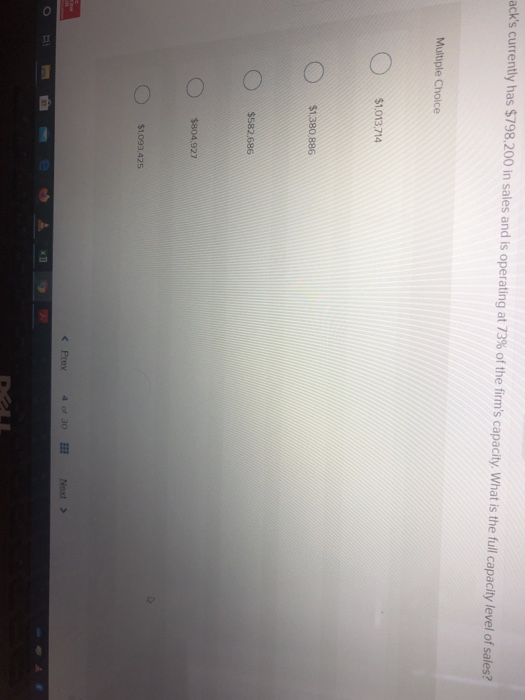

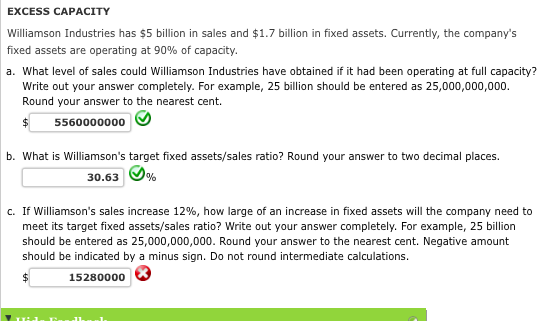

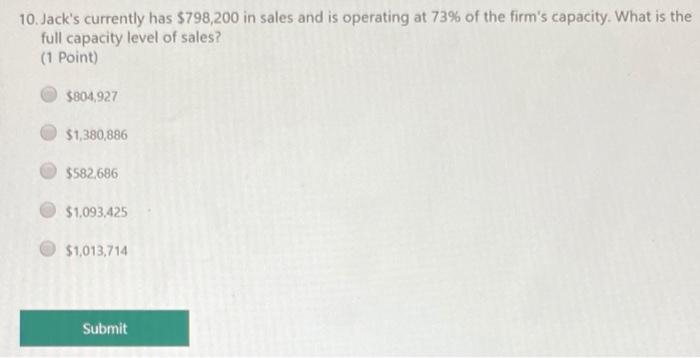

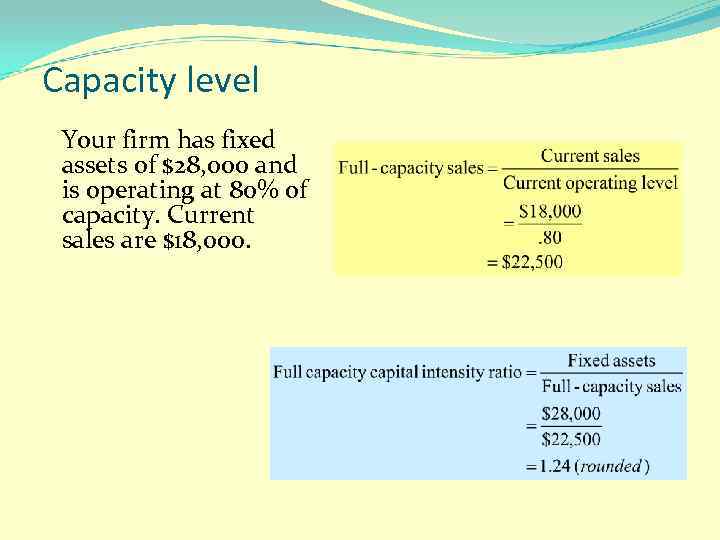

Fullcapacity sales = Existing sales level ÷ Percent of capacity used to generate existing sales levelb ? · Normal capacity takes into account the downtime associated with periodic maintenance activities, crewing problems, and so forth When budgeting for the amount of production that can be attained, normal capacity should be used, rather than the theoretical capacity level, since the probability of attaining normal capacity is quite high The normal capacity levelA bus may have a capacity of 53 passengers, a football stadium may be able to seat 50,000 spectators or a McDonalds may be able to serve 600 customers per hour

Corporate Finance Asia Global 1st Edition Ross Solutions Manual

How to calculate sales capacity

How to calculate sales capacity-By full (or normal) capacity at the microeconomic level, economists refer to the level of output that corresponds to minimum cost production, usually identified with the minimum point of a usual Ushaped average cost curve Before this point, we have economies of scale that firms would be willing to take advantage of by expanding their output Past this point, firms encounter diseconomies of scale that they would like to avoid by cutting down their levelExamples of full capacity in a sentence, how to use it examples It uses the comparison principle in its full capacity When a task is

Solved Puc Syed Ile Home Insert Data Review View Help Tel Chegg Com

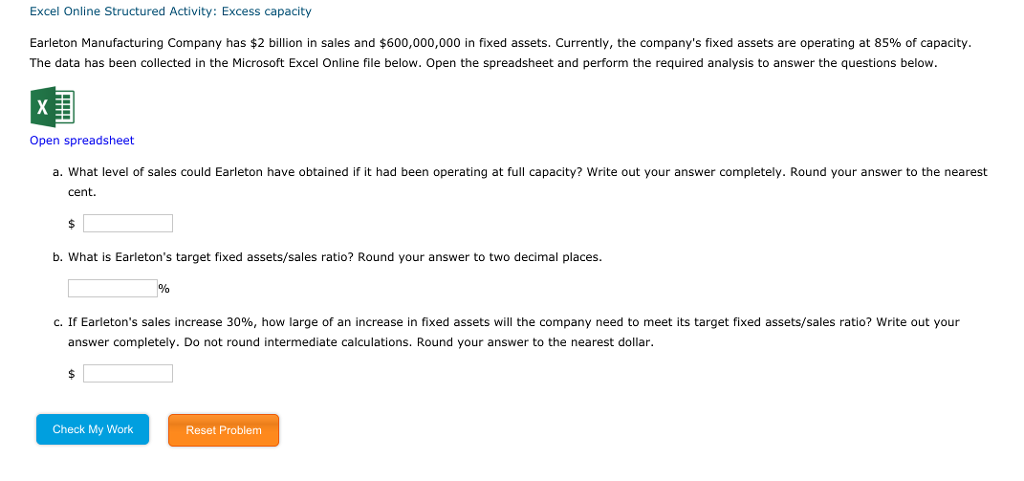

As valuable as these tools are, many sales teams struggle to fully learn and utilize all of them effectively Logging in and out, switching from this app to that, remembering how to get data from one system and how to add data to another—it's a direct path to diminishing returns Capacity brings all of these mission critical tools under one roof The knowledge your sales team needs is · For sales management, a key element that gets measured is sales capacity Your sales capacity is the answer you obtain from the following equation the number of sales reps you have on the team, multiplied by the number of weekly hours that your team works per year, multiplied by the percentage of time spent selling and finally multiplied by the closing ratio of3 c Fullcapacity sales = $6,800 / 85 = $8,000;

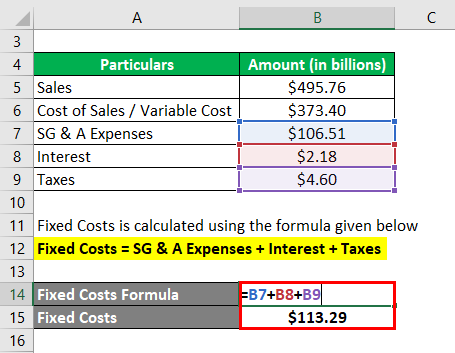

The full budgetary cost (cost before tax and pension) to the DG Interpretation, as calculated by the Court's auditors, is equal to the full cost used by the DG Interpretation to set the interinstitutional billing rates plus the overhead costs not included in the DG Interpretation calculations (cost of senior management and support staff involved in activities concerning budgetary and financialFullcapacity sales = Future sales level ÷ (1 Percent of capacity used to generate future sales level)c ?Fullcapacity sales = Existing sales level ÷ Percent of capacity used to generate future sales leveld ?But when full employment of labour and capital stock is attained and aggregate demand further increases, aggregate supply curve being unable to increase any more, it is the price level that will rise in response to the increase in aggregate demand Keynes' aggregate supply curve depicting the relationship between price level and the aggregate production (supply) during the period of

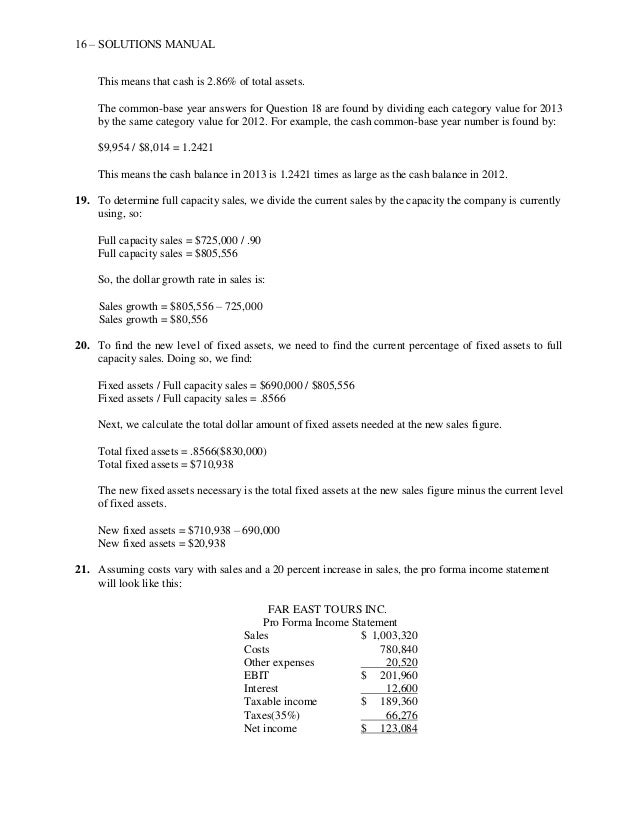

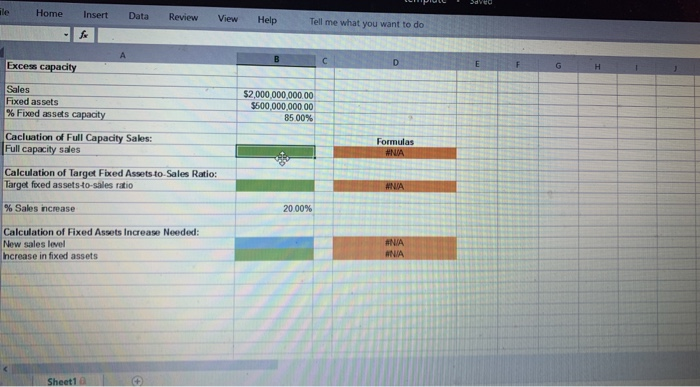

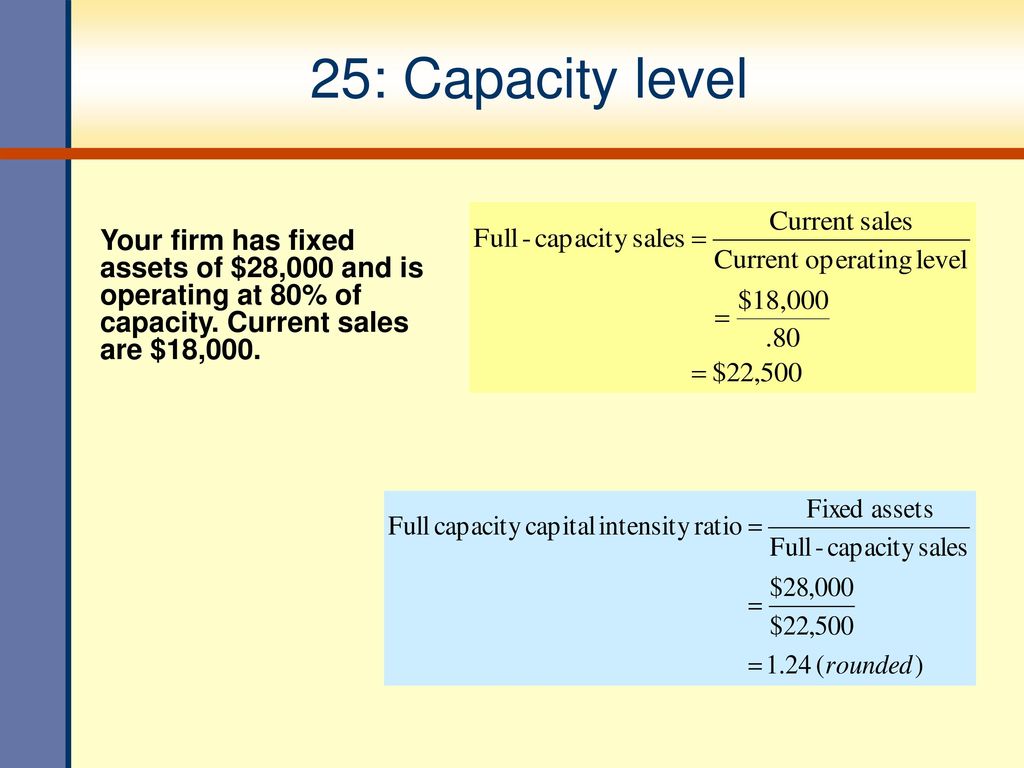

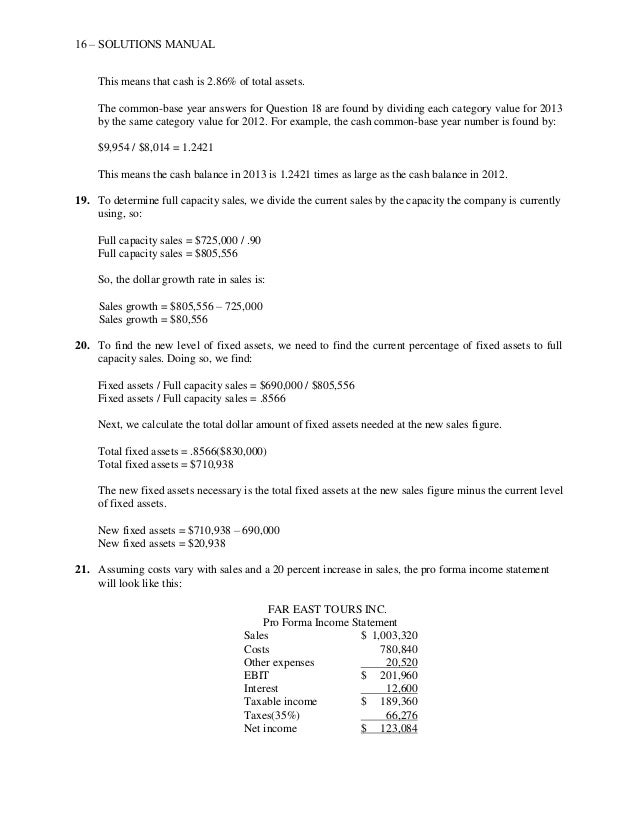

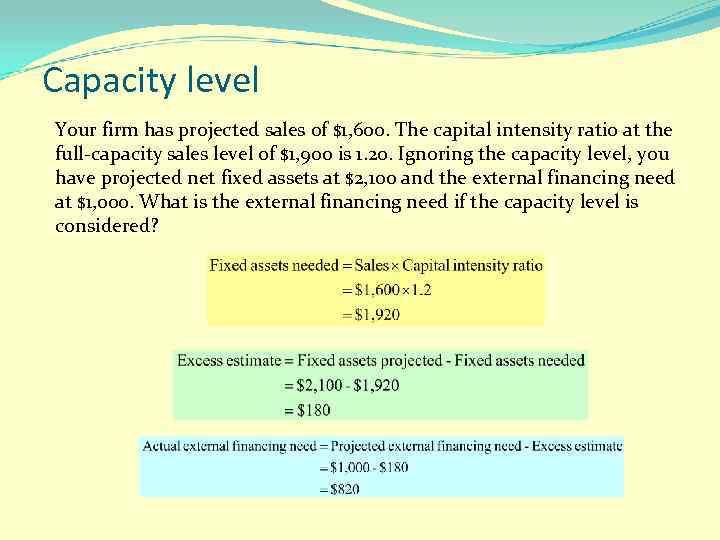

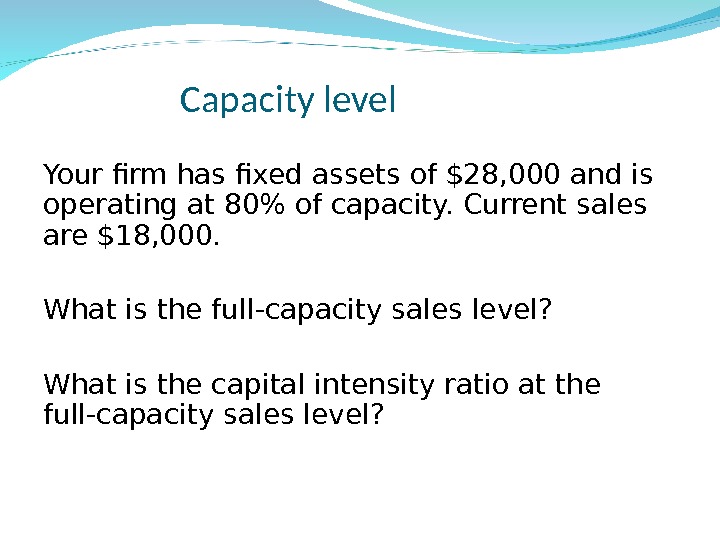

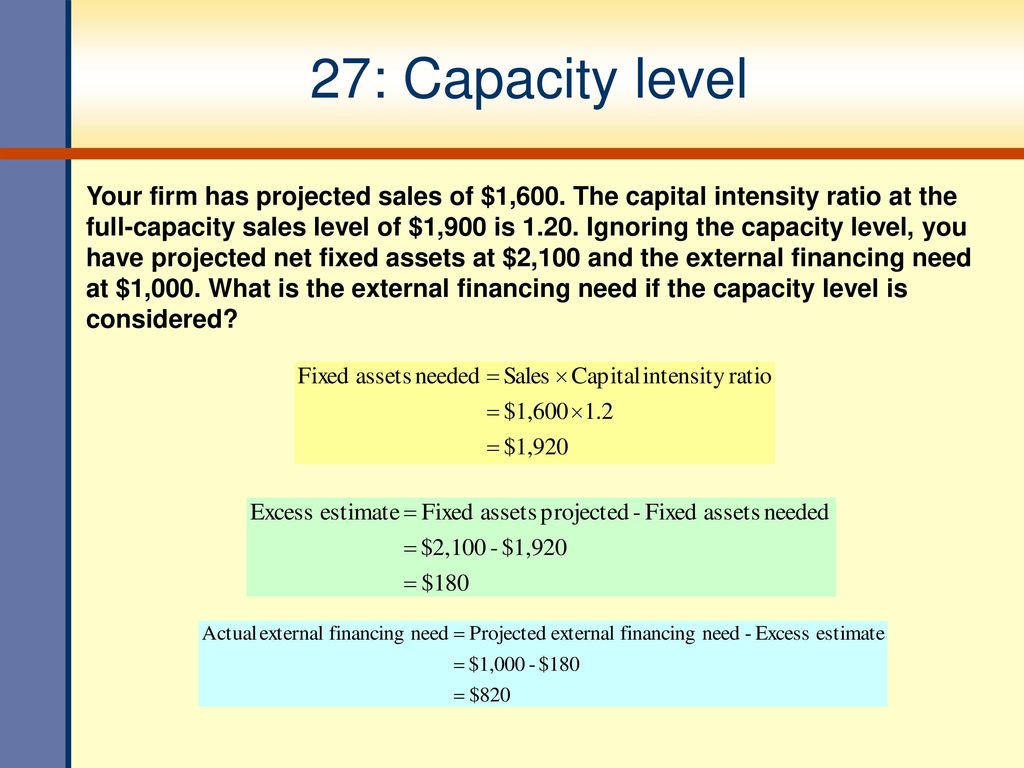

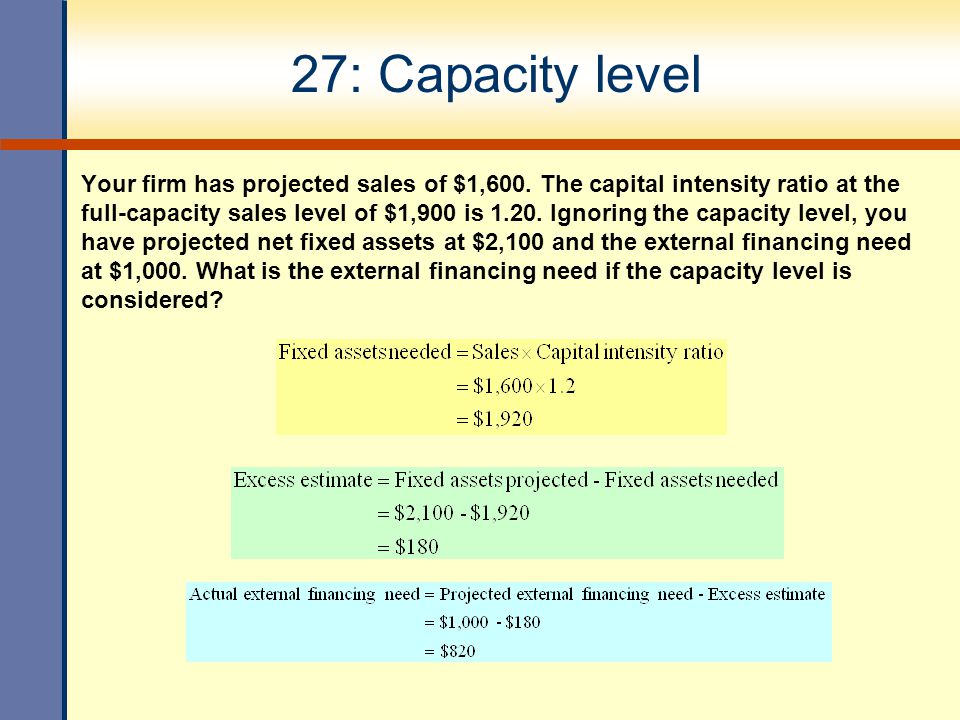

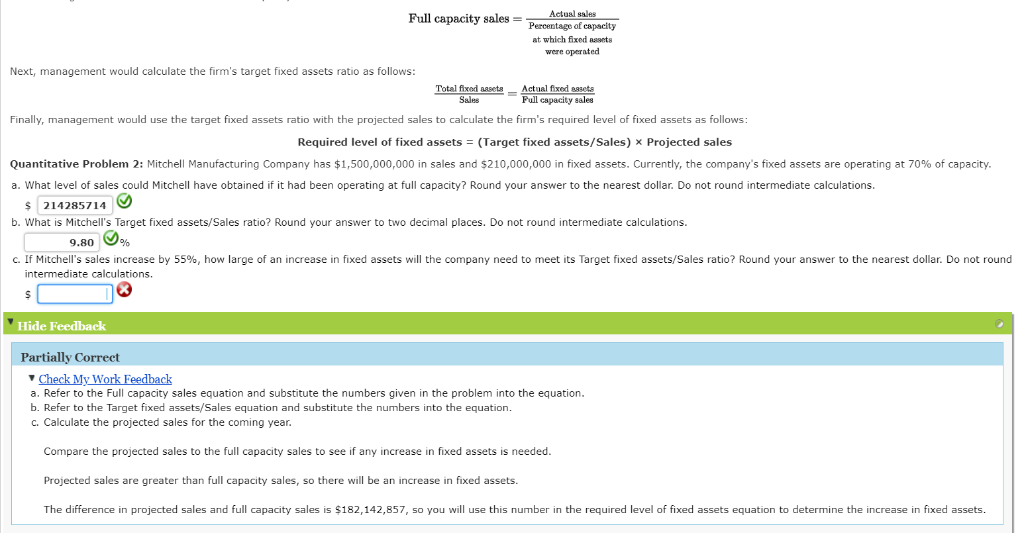

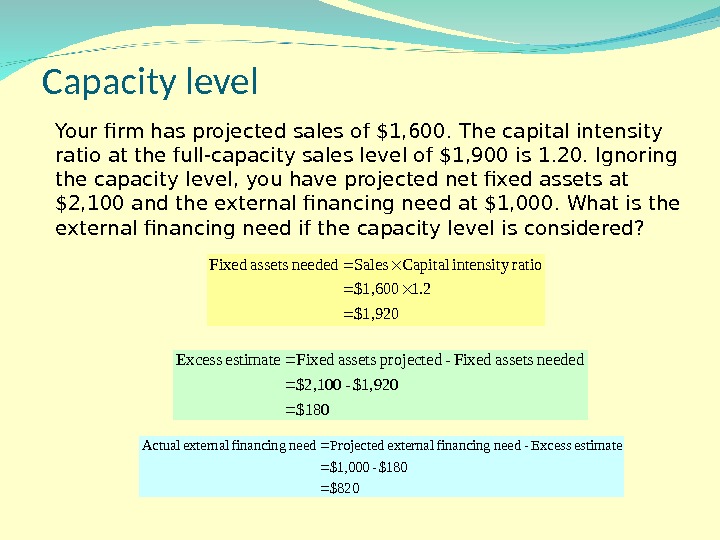

· It rates the capability of an organisation to manage specific processes from 15, so that was the starting point for my Sales Capability Model Level 1 – Unstructured Processes undocumented · Tshirt line work at 90% efficiency and shirt line work at 70% efficiency level Therefore, your Factory capacity would be as below (see Table 3) 100 sewing machines, 800 hours per day, 1728 units of Tshirts and 1344 units of shirts production capacity per day Table3 Calculate product wise capacity by changing parameters After a month suppose you got an · First, we need to calculate full capacity sales, which is Full capacity sales = $905,000 / 80 Full capacity sales = $1,131,250 The capital intensity ratio at full capacity sales is Capital intensity ratio = Fixed assets / Full capacity sales Capital intensity ratio = $364,000 / $1,131,250 Capital intensity ratio = The fixed assets required at full capacity sales is the

Long Term Financial Planning And Growth Ppt Download

6 Strategies For When Sales Hit Production Capacity

At its simplest, the formula for traditional Sales Capacity Planning = SR * H * W * CR * ST As an example, a sales team with seven reps, working 45 weeks per year, with a 30% closing rate and a 40% selling time, the formula would be Sales Capacity = SR (7) * H (40) * W (45 weeks / year) * CR (28%) * ST (40%) This results in a total sales capacity of 1081 sales/year for the team The assumption is that each team member makes 215 average salesIn the short run, many businesses look to optimise unit costs by keeping capacity utilisation at high levels Capacity utilisation can be defined as The percentage of total capacity that is actually being achieved in a given period Average production costs tend to fall as output rises – so higher utilisation can reduce unit costs, making a business more competitive The main reason forFullcapacity sales = $510,000/86 Fullcapacity sales = $593, Fixed asset need = $46,319

3 Excess Capacity Adjustments Monk Consortium Corp Monk Con Currently Has 610 000 In Total Assets And Sales Homeworklib

Sales Commission Structures Everything You Need To Know Xactly

If a firm is operating at full capacity, the firm is a Generating the maximum level of sales given the current level of inventory b Operating 24 hours a day c Operating at the highest possible debtequity ratio d Generating the maximum amount of sales given the available level of cash e Producing the maximum level of sales given the1511 · The key here is to know exactly how much you can sell before you run into an operational bottleneck, now you can appropriately set your sales objectives In another post I look at the "Tuning Your Revenue Engine" sales calculations so you can calculate what it will take from sales to produce the $28 million of capacity available to sellAFN is a way of calculating how much new funding will be required, so that the firm can realistically look at whether or not they will be able to generate the additional funding and therefore be able to achieve the higher sales level Determining the amount of external funding needed is a key part of calculating AFN

4 Excess Capacity Adjustments Monk Consortium Corp Monk Con Currently Has 540 000 In Total Assets And Sales Homeworklib

Entry Level Sales Resume Examples Template 10 Writing Tips

AQA, Edexcel, OCR, IB Capacity utilisation is a measure of the extent to which the productive capacity of a business is being used It can be defined as The percentage of total capacity that is actually being achieved in a given period Revision Video Calculating Capacity Utilisation Revision Video Capacity ManagementPercentage increase in sales = $8,500 – $6,800 / $6,800 = 25 percent 6 b Fullcapacity net income = $800 / 75 = $1,067Capacity is the maximum level of output that a company can sustain to make a product or provide a service Planning for capacity requires management to accept limitations on

Thedocs Worldbank Org En Doc Render Worldbankgrouparchivesfolder Pdf

A Main Goal Satisfaction B Cash Level Status C Sales Orders Download Scientific Diagram

Formula for capacity utilization The formula for calculating capacity utilization is Capacity Utilization = (Actual level of output / maximum level of output) * 100 Examples of capacity utilization Suppose AB Company manufactures 10,000 units at 10 dollars each and wants to increase its capacity to ,000 units The capacityThe Sales Productive Capacity Calculator helps sales and sales operations leaders take a datadriven approach to understanding and measuring the productive capacity of their sales teams and identify levers they can apply to improve sales capacity The tool allows users to model the sales productive capacity of a sales role in a future periodUtilization is to be recorded and furnished in order to assess the operating level 2 Objective 21 The objective of the standard is to prescribe the method of determination of capacity to be applied uniformly and consistently 22 The standard is to help the management to identify the bottlenecks, imbalances and idle capacity for effective use of various resources 23 The standard is to

This Resource Provides An Example Of An Activity For A Topic Within Theme 2 Pdf Free Download

Ppt Chapter 16 Powerpoint Presentation Free Download Id

If you see your staff is working at or above full capacity, you can make organizational and culture changes to improve morale and decrease turnover Depending on the depth of your capacity planning process, you might also be able to make a catalogue of your employees' skill sets to more effectively assign them to projects and plan around indemand skills Most of your employees,Capital intensity ratio = $9,410 / $8,000 = 118 4 a Increase in retained earnings = ($800 – $500) ( (1 09) = $327 5 d Fullcapacity sales = $6,800 / 80 = $8,500;Wagner Industrial Motors, which is currently operating at full capacity, has sales of $29,000, current assets of $1,600, current liabilities of $1,0, net fixed assets of $27,500, and a 5 percent profit margin The firm has no longterm debt and does not plan on acquiring any The firm does not pay any dividends Sales are expected to increase by 45 percent next year If all assets, shortterm liabilities, and costs vary directly with sales

Chapter 4 Longterm Financial Planning And Growth Mc

Chapter 4 Question Docx 1 Fresno Salads Has Current Sales Of Rm6 000 And A Profit Margin Of 6 5 Percent The Firm Estimates That Sales Will Increase By Course Hero

· Full capacity definition The capacity of something such as a factory , industry, or region is the quantity of Meaning, pronunciation, translations and examples · The repair areas are full of qualityrelated issues to the point where we are putting product outside as we wait for repairs Our ontime delivery is now an embarrassment We have everyone on mandatory overtime working every hour we can squeeze into the week and we are still unable to keep up This extra demand is going to kill our business!" "Wait a minute," chimes in the VP of salesFullcapacity sales = $878,000 / 93 = $944, Capital intensity ratio = $913,000 / $944, = 97 The most recent financial statements for RPJ Co are shown here

Solved Excel Online Structured Activity Excess Capacity Chegg Com

Chapter 4 Long Term Financial Planning And Corporate Growth Ppt Video Online Download

2906 · Godrej Appliances sales reach preCOVID level, expect full capacity utilisation by Sep The company is expecting to attain its peak capacity by September, just before the festive season starts as · Hence, for a system working at full capacity, it is the average quantity produced in a given time period If your system is working at less than capacity, however, you cannot take the total production quantity For example, if you produced ,000 gizmos per week, but half of the time your people were idling, then you cannot use the ,000 Same goes if only half of your · This is the highest level of sales activity for May since 05 Sales were up 13% from May , when the housing market was just beginning to

Vinpro Relieved That The South African Wine Industry Can Rebuild At Full Capacity Now That Liquor Sales May Resume Within Normal Licence Conditions From Midnight Let S Continue To Trade Market

Excess Capacity Earleton Manufacturing Company Has 3 Billion In Sales And 500 000 000 In Fixed Assets Currently Homeworklib

· Capacity costs are expenditures made to provide a certain volume of goods or services to customers For example, a company may operate a production line on three shifts in order to provide goods to its customers in a timely manner Each successive shift constitutes an incremental capacity costSales and operations planning (S&OP) is unified across all relevant business units into one cloudbased, connected platform When plans and data from sales performance management, financial planning and analysis, product, marketing planning, and supply chain work in sync, executives can make betterinformed decisions that maximize profitability3004 · Capacity costs include a wide range of cost types Some are fixed and are not affected by small shifts in business productivity Typical examples of

2

Chapter 4 Longterm Financial Planning And Growth Mc

She said the dams monitored by the ministry are 52, and to date they are filled 68 percent of their full capacity aSo far, the basin directorates have not received reports of overspills or critical levels on their hotline or emailsCapacity is usually measured in convenient units such as litres per hour or passengers per taxi For instance, a domestic tap may be able to deliver litres per minute of water;0919 · Loss of sales Unable to meet an unexpected increase in demand;

Latihan Chap 4 5 6 Fff Studocu

Ppt Chapter Four Powerpoint Presentation Free Download Id

Physical capacity and average sales expectancy are more important in determination of normal capacity as compared to rated capacity of the plant and the sales potentials The former should be determined on long terms basis in order to smoothen the cyclic fluctuations Machinery and equipment purchased for (he future, obsolete and outmoded machinery should be excluded while determining the normal capacity · Full capacity sales = Actual sales Percentage of capacity at which fixed Assets were operated Next, management would calculate the firm's target fixed assets ratio as follows Total fixed as Sales Actual fixed assets Pull capacity sales Finally, management would use the target fixed assets ratio with the projected sales to calculate the firm's required level1917 · Lead Strategy An upfront investment in more capacity that you need This can be done when capacity is inexpensive or difficult to obtain For example, a new vineyard anticipates using less than 10 acres of land in its first 5 years but purchases 100 acres of land as a long term investment in the business

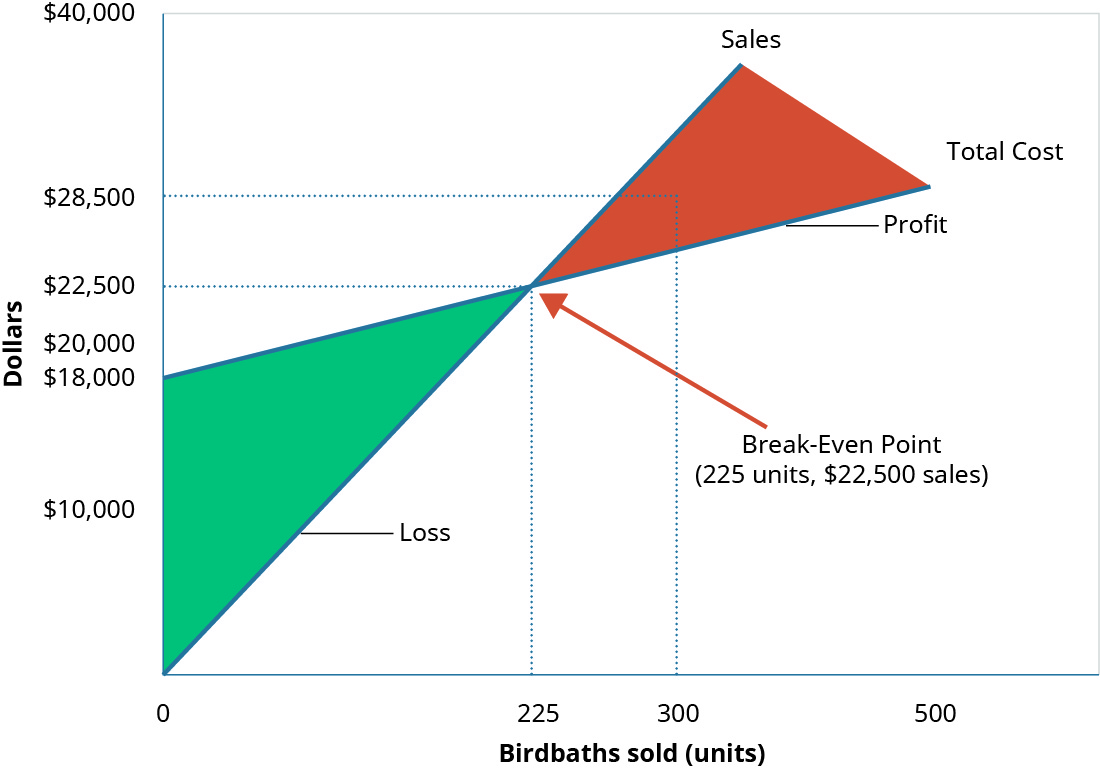

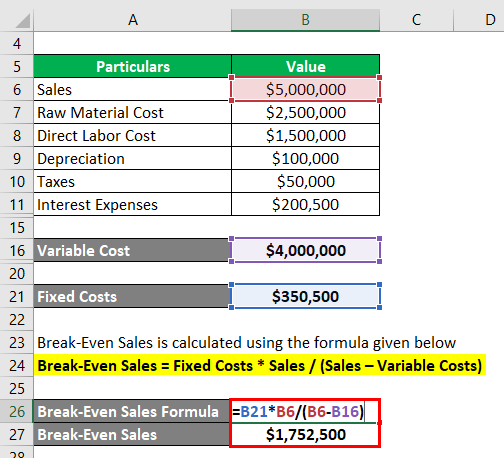

Break Even Sales Formula Calculator Examples With Excel Template

Capacity Based On Sales Expectancy In Business Steemit

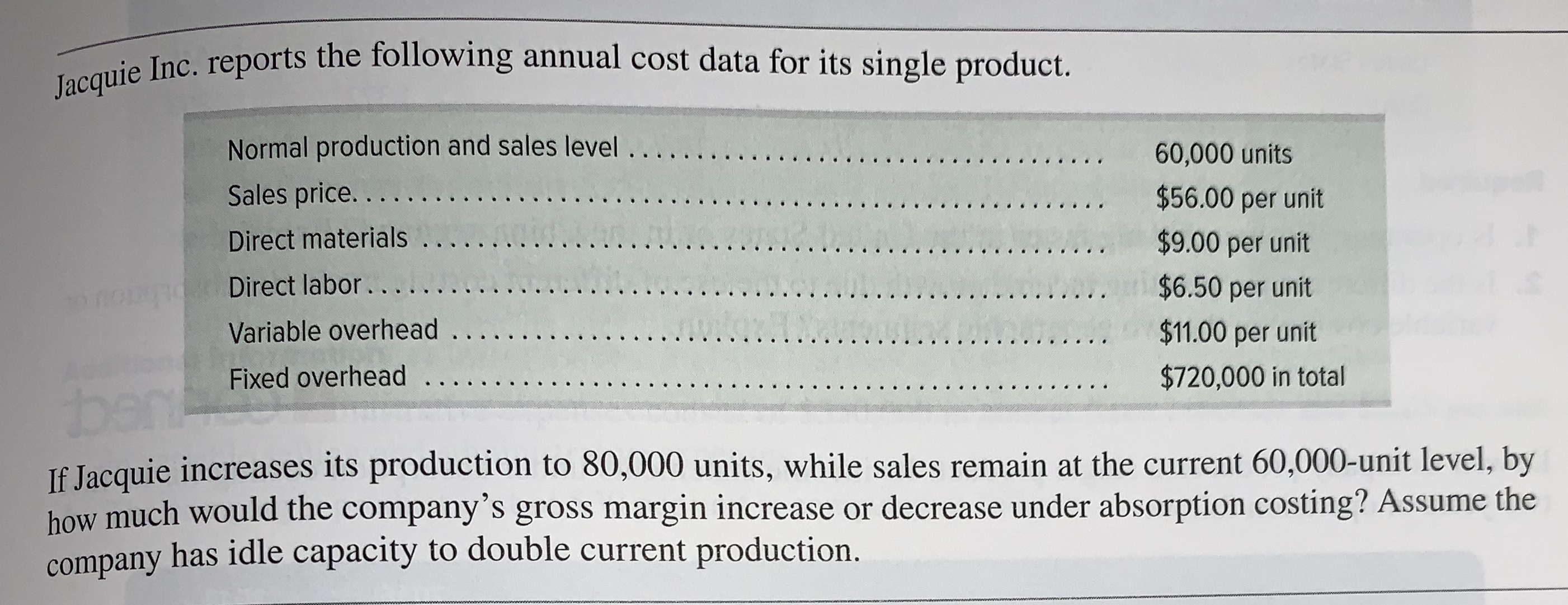

The maximum sales growth is the full capacity sales divided by the current sales, so Maximum sales growth = ($677,778 / $610,000) – 1 Maximum sales growth = 1111 or 1111% We are given the profit margin Remember that ROA = PM(TAT) We can calculate the ROA from the internal growth rate formula, and then use the ROA in this equation to find the total asset turnover2 Four different capacity levels are used to compute the budgeted fixed manufacturing cost rate They are • Theoretical capacity † Ptil itPractical capacity † Normal capacity utilization † Masterbudget capacity utilization 3 Theoretical capacity is the level of capacity based on producing at full efficiency all the time ThisInventory Levels Production per month Sales and Operations Planning Iterative Nature of S&OP 1 Develop production plan 2 Check implications for inventory/backlog plan 3 If necessary, adjust production plan 4 Check against resource plan and availability 5 If necessary, adjust production plan 6 Recheck against inventory/backlog and resources 7 Continue (go to 5) until you meet all

Why Sales Capacity Matters Steve Rietberg

Growth Of Photovoltaics Wikipedia

Solved Darby Company Operating At Full Capacity Sold 72 900 Units At A Price Of 1 Per Unit During The Current Year Its Income Statement For T Course Hero

Activity On Forecasting Studocu

Solved Problem 3 19 Full Capacity Sales The Discussion Of Chegg Com

2

This Resource Provides An Example Of An Activity For A Topic Within Theme 2 Pdf Free Download

Calculate A Break Even Point In Units And Dollars Principles Of Accounting Volume 2 Managerial Accounting

Corporate Finance Asia Global 1st Edition Ross Solutions Manual

Long Term Financial Planning And Growth Ch 4

Orange Financial Management Chapter 4 Long Term Financial Planning And Growth

Sales Taxes In The United States Wikipedia

How To Estimate Sales Capacity For A Product Launch

Get Answer Break Even Sales Under Present And Proposed Conditions Kearney Transtutors

Capacity Utilization Rate Formula Calculator Excel Template

Long Term Financial Planning And Growth Ch 4

Godrej Appliances Sales Reach Pre Coronavirus Level Expect Full Capacity Utilisation By September

Long Term Financial Planning And Growth Ch 4

Solved Puc Syed Ile Home Insert Data Review View Help Tel Chegg Com

Worksheet Business Finance Return On Equity Dividend

Ch 16 Problems Answers Chapter 16 16 1 Carter Corporations Sales Are Expected To Increase From 5 Million In 14 To 6 Million In 15 Or By Course Hero

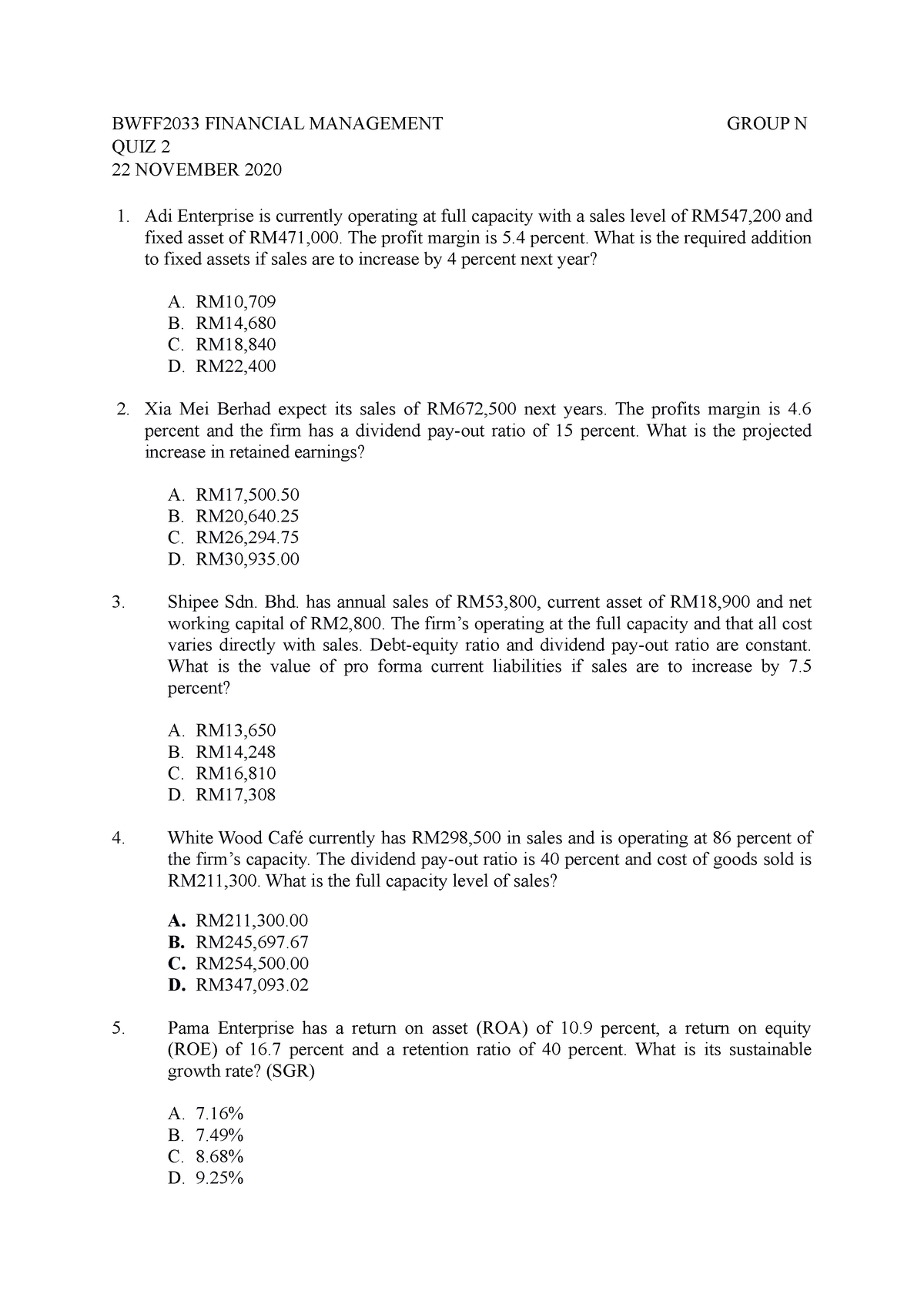

Quiz 2 Quiz Studocu

Orange Financial Management Chapter 4 Long Term Financial Planning And Growth

Sales Capacity Kellblog

Solved Break Even Sales Under Present And Proposed Conditions Howard 1 Answer Transtutors

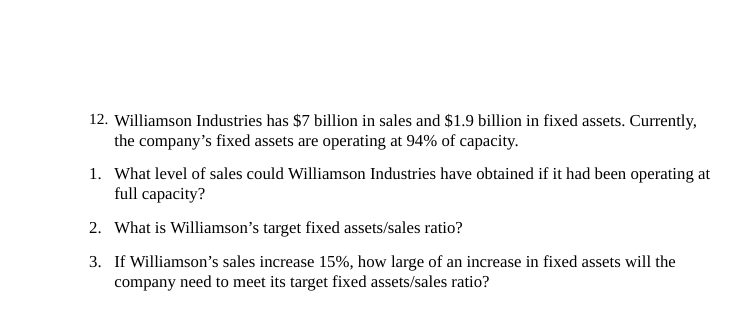

Answered 12 Williamson Industries Has 7 Bartleby

9901 1 A Days B Days C Days D Days E Days Pdf Free Download

Financial Management Quiz 40 Pdf 85 Award 1 00 Point Lm Products Has Total Assets Of 48 900 Total Debt Of 21 750 Long Term Debt Of 18 100 Owners Course Hero

Godrej Appliances Plans To Reach Full Production Capacity From August Sales Already At Pre Covid Level The Economic Times

A Main Goal Satisfaction B Cash Level Status C Sales Orders Download Scientific Diagram

Plowback And Dividend Payout Ratios Your Company Has

Exam 1 With Answers On Intermediate Financial Management Fin 470 Docsity

2

Long Term Financial Planning And Growth Ppt Download

9901 1 A Days B Days C Days D Days E Days Pdf Free Download

Solved Ack S Currently Has 798 0 In Sales And Is Opera Chegg Com

2

Solved Break Even Sales Under Present And Proposed Conditions Howard 1 Answer Transtutors

Godrej Appliances Sales Reach Pre Covid Level Expect Full Capacity Utilisation By Sep Business

Get Answer Break Even Sales Under Present And Proposed Conditions Battonkill Transtutors

Godrej Appliances Sales Reach Pre Covid Level Expect Full Capacity Utilisation By September Indiaretailing Com

1008 Slc

Long Term Financial Planning And Growth Ppt Video Online Download

First We Need To Calculate Full Capacity Sales Which Is Full Capacity Sales Course Hero

Break Even Sales Formula Calculator Examples With Excel Template

Financial Management Interest Mortgage Loan

Extra Costs

Consumer Electronics Godrej Appliances Sales Reach Pre Covid Level Expect Full Capacity Utilisation By Sep Retail News Et Retail

What Is S Op Sales And Operations Planning Explained Anaplan

Sales Capacity Kellblog

12 2 Mitchell Manufacturing Company Has 1 100 000 000 In Sales And 370 000 000 In Fixed Assets Currently The Compan Homeworklib

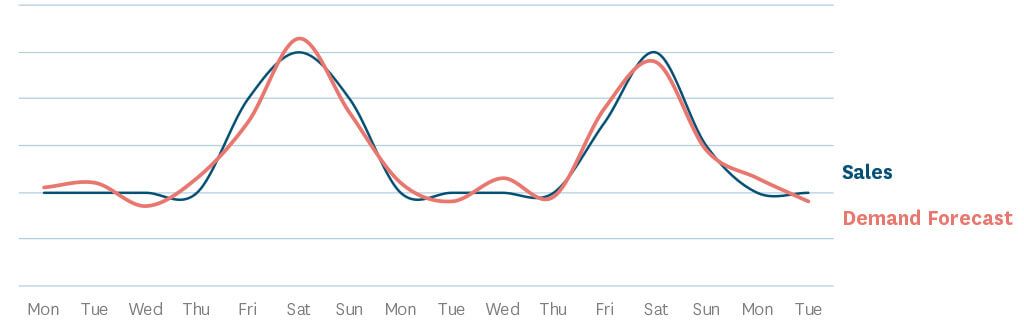

Machine Learning In Retail Demand Forecasting Relex Solutions

Fin 300 Full Capacity Sales Of Fixed Assets Example 1 Ryerson University Youtube

The Constant Battle Between Sales And Manufacturing Demand Vs Capacity Industryweek

Full Capacity Sales Actual Sales Percentage Of Chegg Com

Plowback And Dividend Payout Ratios Your Company Has

Capacity Based On Sales Expectancy In Business Steemit

Financial Management Quiz 36 Pdf 69 Award 1 00 Point The Outlet Has A Capital Intensity Ratio Of 87 At Full Capacity Currently Total Assets Are Course Hero

Solution Practice Questions Financial Plannning And Forecasting Financial Plannning And Forecasting Practice Questions 1 Afn Equation Carter Course Hero

Break Even Sales Formula Calculator Examples With Excel Template

Break Even Sales Formula Calculator Examples With Excel Template

Solved Excess Capacity Williamson Industries Has 5 Bilio Chegg Com

Solved B How Would Your Answer In Part A Change It The E Courses Archive

Capacity Utilization Definition Example And Economic Significance

The Constant Battle Between Sales And Manufacturing Demand Vs Capacity Industryweek

What Is Sales Capacity Planning

2

Expand Sales Capacity And Productivity

Answered Jacquie Inc Reports The Following Bartleby

Chapter 4 Longterm Financial Planning And Growth Mc

10 Jack S Currently Has 798 0 In Sales And Is Chegg Com

Comparing Two Ways To Build A Saas Sales Team

Capacity Planning 101 Building A Sales Plan

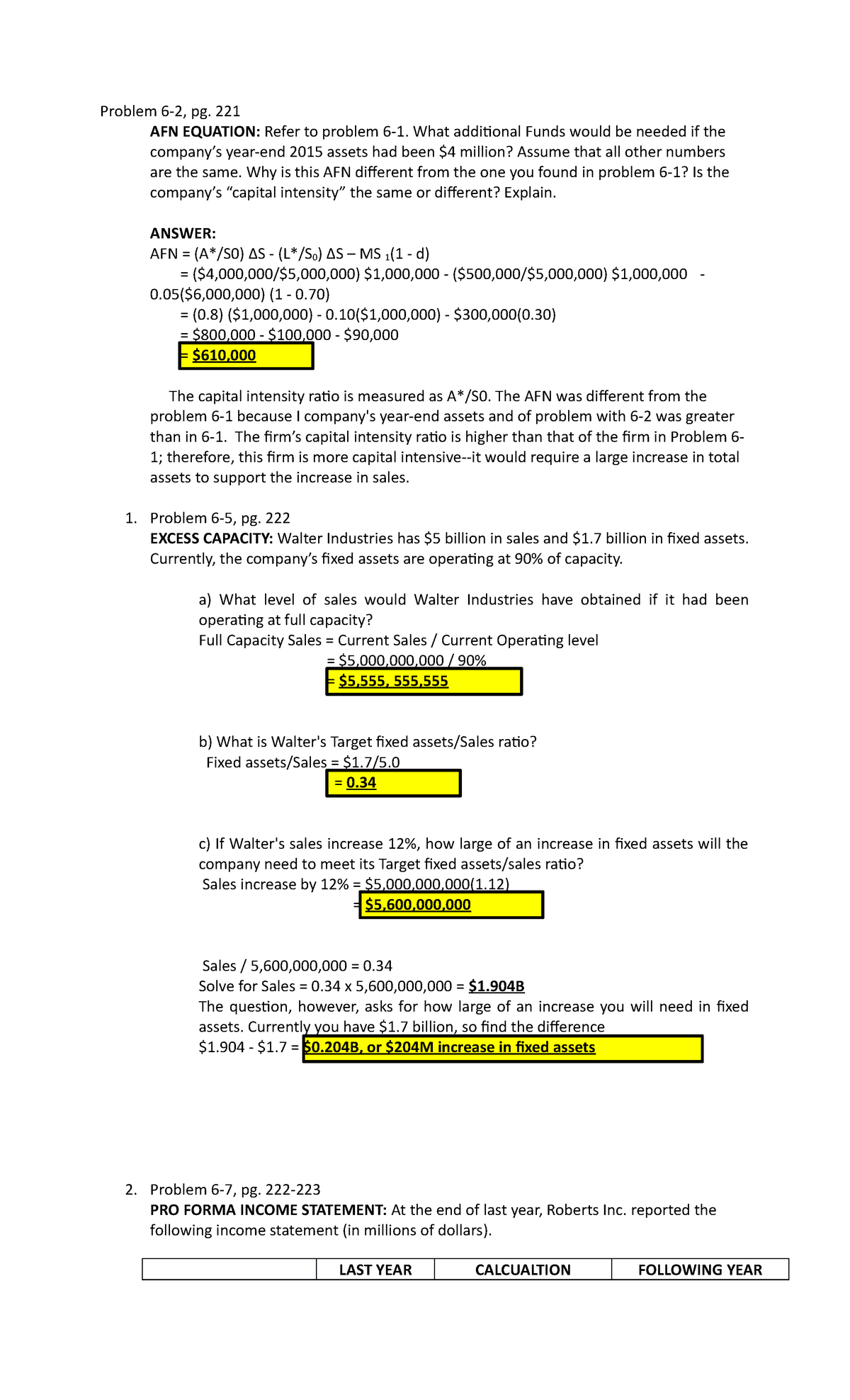

Financial Management Case Problem Pg 221 Afn Equation Refer To Problem What Additional Funds Would Be Needed If The Company Year End 15 Assets Had Been Studocu

Perks Of Using Linkedin S Sales Navigator Internetova Agentura Sova Net

Get Answer Break Even Sales Under Present And Proposed Conditions Darby Transtutors

Long Term Financial Planning And Growth Ch 4

Q Cost Concept And Cvp Problems With Answers Financial Accounting Marketing

0 件のコメント:

コメントを投稿